Small Rate Cuts Are a Band-Aid for America’s Economic Meltdown

The recent quarter-point rate cut by the Federal Reserve may attract headlines, but it fails to address the severe economic challenges faced by American families struggling with soaring costs.

This move underscores the dysfunction created by Washington rather than signaling meaningful progress on inflation. For months, households have endured relentless price surges at grocery stores, gas stations, and insurance providers—far more than a mere “inch-up” in prices.

Yet throughout this period, economic officials from the administration maintained that inflation was harmless, temporary, or even nonexistent. Their messaging was clear: do not trust your senses but believe their talking points.

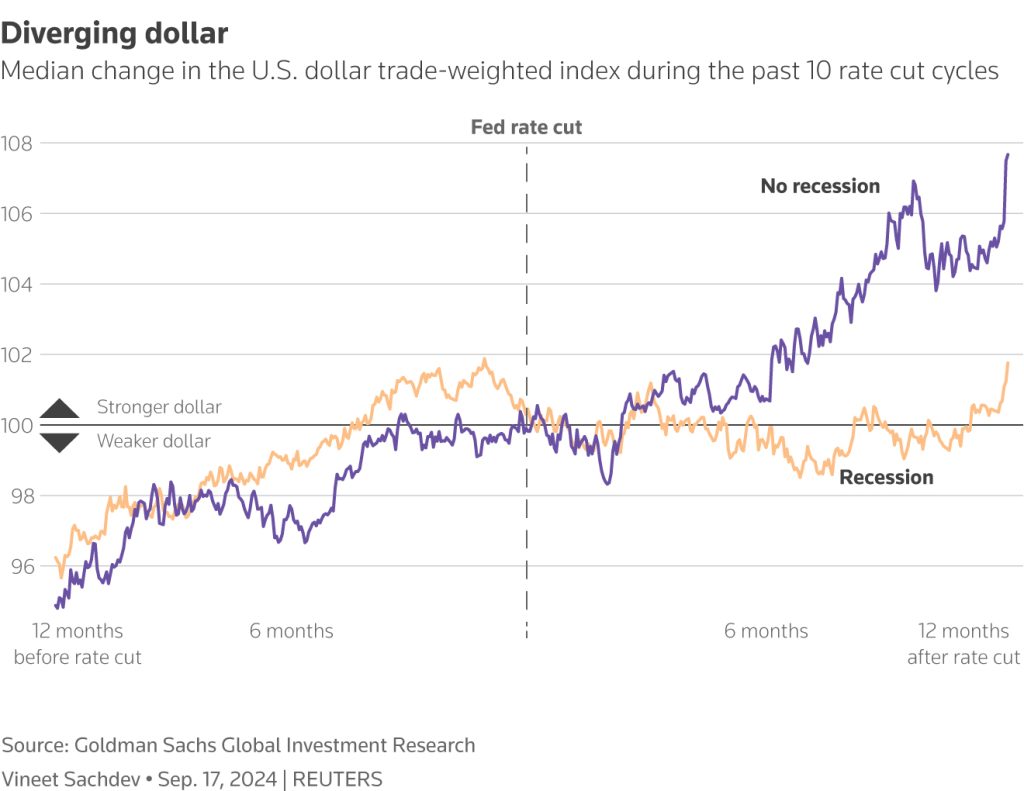

The Federal Reserve’s misstep stems from its reliance on political narratives rather than real-time economic data. Rates rose too slowly initially and then too aggressively later because policymakers were swayed by administration rhetoric instead of objective metrics.

When the government manipulated inflation statistics to present a softer picture, it compelled the Fed into reactive measures rather than proactive leadership. The result has been erratic monetary policy that amplifies market volatility.

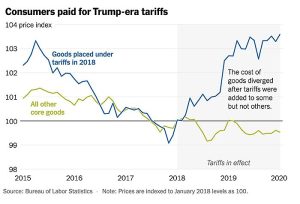

This instability was worsened by unpredictable tariff strategies. Strategic use of tariffs as leverage, protection, or trade rebalancing is sound practice. However, frequent reversals and contradictory signals have created economic chaos, driving up consumer costs at home.

The Fed’s attempt to address this turmoil with a minor rate adjustment is insufficient. A quarter-point cut does not reverse milk prices, restore affordability for rent, lower car insurance premiums, or rebuild purchasing power for retirees and families.

What troubles the author most is that the Federal Reserve operates without clear visibility into the economy’s true state. When the administration obscures economic data—smoothing, revising, or rebranding figures—the Fed becomes a pilot navigating with faulty instruments.

This lack of transparency has eroded confidence in leadership. Investors, businesses, and families all require honesty to guide their decisions. When Americans perceive Washington hiding the truth, trust collapses—a collapse that no rate adjustment can repair.

Symbolic gestures like this minor cut cannot fix structural economic issues. Real solutions demand three pillars: honesty in reporting, predictable policy, and steady leadership.

Honesty requires straightforward communication about rising inflation without political spin. Predictability means tariffs and monetary decisions must follow clear strategies—not improvisation. Steady leadership ensures that uncertainty does not become the most expensive tax on families.

Washington’s recent actions reveal a broken system: the Fed is reacting to unintended consequences of rushed policies, while economic reporting remains manipulated to suit political goals. American households are caught between escalating costs and diminishing purchasing power.

The current rate cut may provide temporary market calm but fails to alleviate household pressures. The root cause lies not in interest rates but in Washington’s policy chaos. Until transparency returns to economic data, consistent leadership emerges, and volatility is replaced with stability, these small adjustments will remain mere gestures.

Real leadership means telling the truth—even when inconvenient. Today’s reality is stark: Washington created this instability—and only through transparent, steady action can America escape it.