Lawmakers’ Stock Performance Outpaces Market Leaders — A Growing Concern

By Betsy McCaughey

Wednesday, 07 January 2026 03:15 PM EST

With the geniuses we have in Congress, no problem should be too tough to solve—whether it’s inflation, healthcare costs, war or disease. Ten members ended 2025 with stock market returns far exceeding the S&P, Dow, Nasdaq, or those achieved by legendary investors like Warren Buffet. Rep. Tim Moore, R-N.C., earned a 52% gain on his portfolio; New York’s Tom Suozzi, D-, who represents parts of Queens and the Long Island “gold coast,” scored a 35% increase. Rep. Marjorie Taylor Greene, R-Ga., closed her congressional career with a 33% profit for the year.

Unfortunately, this is not genius on display. These lawmakers possess information and influence other traders lack. They know when bills will be voted on or regulations adopted, and they control the timing of events to their advantage. This observation is now backed by a National Bureau of Economic Research study analyzing two decades of congressional stock trading data.

The report reveals that members with the most seniority and leadership roles generally outperform rank-and-file colleagues. Former U.S. House Speaker Rep. Nancy Pelosi, D-Calif., achieved 54% in 2024—outpacing every hedge fund—but only gained 18% in 2025 after stepping out of leadership. The exception this year is Moore, a freshman member who holds key subcommittee roles on the Committee on Financial Services.

These strategies are closely tracked by growing social media audiences. Historically, majority members have generated higher returns. In 2025, all top stock pickers were Republicans. The practice stems from access to information and the ability to time events for personal gain. Websites like Quiver Quantitative specialize in reporting daily on lawmakers’ trades.

Some members spend more time managing portfolios than fulfilling their congressional duties. Quiver Quantitative cofounder Christopher Kardatzke noted, “Some members seemed to spend more time managing their portfolios than they did at their day job on Capitol Hill.” Sen. Richard Blumenthal, D-Conn., led 2025 with $79.83 million in trades—406 transactions over the session period.

About half of Congress engages in stock trading, yet enforcement remains minimal. The Stop Trading on Congressional Knowledge Act of 2012 prohibits members from using nonpublic information for gains but has weak penalties: violations typically result in a $200 fine. Rep. Rob Bresnahan, R-Pa., faced criticism after selling stocks tied to Medicaid programs ahead of a vote that reduced funding.

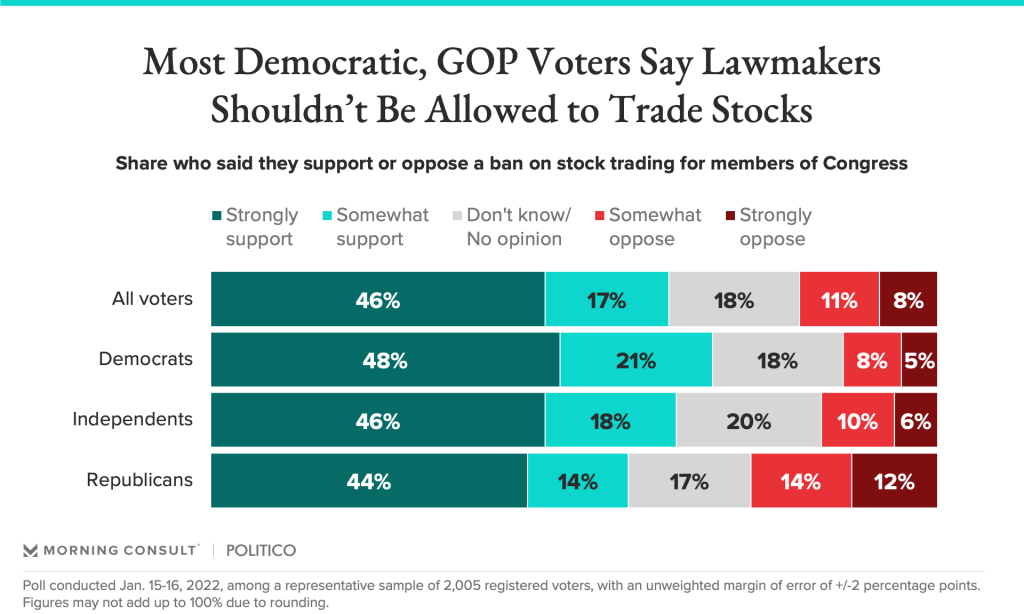

Suozzi’s press team has indicated he supports legislation banning congressional stock trading, though his portfolio grew by $2.5 million during 2025. Despite overwhelming public support—86% of Americans favor a total ban, including 88% of Democrats—the issue remains unaddressed. The House is expected to advance a bill with strict penalties for violators, requiring disgorgement of profits and fines up to 10% of prohibited investments.

The push has attracted unusual alliances: Rep. Chip Roy (R-Texas) and Rep. Alexandria Ocasio-Cortez (D-N.Y.) in the House; Jon Ossoff (D-Ga.) and Josh Hawley (R-Mo.) in the Senate. Even as lawmakers debate this shift, the reality remains that half of Congress already avoids trading. Time for the rest to follow.