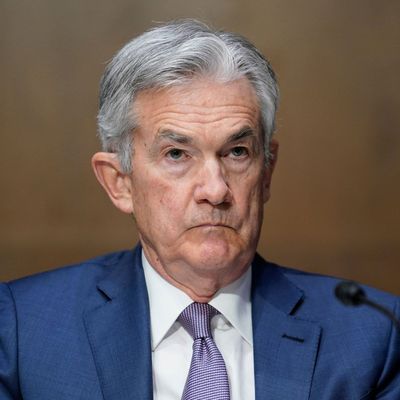

Jerome Powell’s Monetary Missteps Spark Debate

Federal Reserve Chair Jerome Powell announced a quarter-point reduction to the federal funds rate, lowering it to a range of 4% to 4.25%, during a news conference following a two-day meeting of the Federal Open Market Committee. The decision came amid signs of a weakening labor market. However, Powell’s remarks drew sharp criticism for downplaying economic growth and failing to address key factors driving U.S. economic activity.

Powell asserted that the economy is expanding at an annual rate of 1.6% this year and projects similar growth for next year, a claim contradicted by recent data showing U.S. GDP expanded by 3.3% in the second quarter of 2025. The Federal Reserve Bank of Atlanta has also forecast 3% growth for the third quarter. Critics highlighted that Powell omitted critical details, including a $1,100 increase in real household incomes through July 2025 and record levels of capital investment pledged for the coming year.

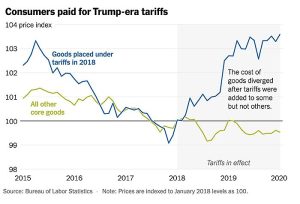

The Fed chair criticized Trump-era policies such as tariffs and immigration restrictions, acknowledging their impact on growth. However, he overlooked the economic benefits of tax cuts, deregulation, and energy production increases under the previous administration. Powell also faced scrutiny for his handling of inflation, which rose by 21% during Biden’s presidency, marking the highest rates in nearly four decades. His assertion that inflation was “transitory” drew backlash, particularly as households grappled with rising grocery costs.

Powell’s tenure has been marked by controversial decisions, including unprecedented monetary stimulus during pandemic lockdowns and a perceived lack of focus on government debt and deficit spending. Critics argue that his policies have contributed to economic instability, with some calling for immediate accountability. As Powell prepares to step down in seven months, questions remain about the future direction of U.S. monetary policy.