Donald Trump’s Tariff Rebate Idea Sparks Economic Debate

MINT HILL, NORTH CAROLINA - SEPTEMBER 25: Republican presidential nominee, former U.S. President Donald Trump speaks to attendees during a campaign rally at the Mosack Group warehouse on September 25, 2024 in Mint Hill, North Carolina. Trump continues to campaign in battleground swing states ahead of the November 5 presidential election. (Photo by Brandon Bell/Getty Images)

Donald Trump has proposed using revenue generated from recent trade tariffs to distribute $2,000 payments to American citizens.

In a social media post, President Trump suggested that surplus tariff funds could be used “substantially pay down national debt” or provide direct cash transfers. However, his proposal faces criticism for several key issues according to Professor Paul F. deLespinasse.

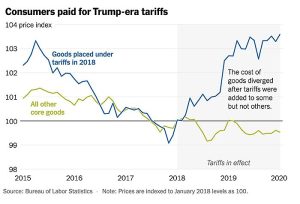

While acknowledging the concept has merit in principle, deLespinasse argues there are fundamental flaws with the approach. First, he clarifies that tariffs’ revenue isn’t “pouring into” the U.S. as Trump claims, but rather represents an additional tax burden on American consumers and businesses.

The taxes would be passed on through higher prices for imported goods or absorbed by companies doing business internationally. This contradicts the popular narrative of windfall profits from foreign importers.

Second, calculations show that these tariffs have generated insufficient funds to even cover a fraction of such large payments to citizens. The revenue simply isn’t substantial enough.

Third, legal experts warn that without proper congressional authorization, the president may lack authority for implementing rebates through executive order – a potential constitutional issue.

Despite these concerns, deLespinasse suggests there is value in examining the core idea: creating an economic system where trade barriers generate funds to return directly to citizens. He points out two stated goals behind this approach – covering government costs and encouraging domestic business investment.

However, the rebates would conflict with funding the government while potentially supporting local manufacturing incentives through tax reductions for businesses.

deLespinasse draws parallels between tariff rebates and environmental policies like carbon taxes that are designed by redistributing burdens fairly among citizens. He suggests a more equitable approach might involve proportional distributions based on family size rather than one-size-fits-all payments, with adjustments to ensure fair benefit distribution across households.