Subsidy Cuts Expose Obamacare’s Hidden Costs: A Broken Insurance Market

By Sally Pipes

Friday, 13 February 2026 04:44 PM EST

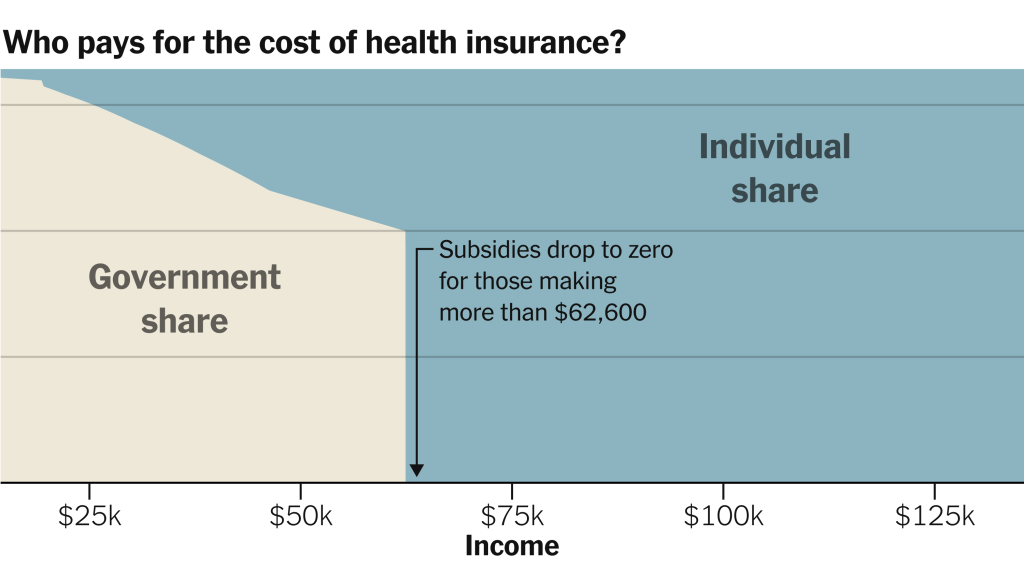

The federal government is now covering a smaller share of Obamacare enrollees’ premiums this year. This shift has raised concerns among Democrats about a potential surge in the number of uninsured Americans as individuals face higher out-of-pocket costs.

Recent reports have documented several Californians whose premium subsidies have shrunk this year. One such individual is a 29-year-old publicist from Los Angeles who lives with epilepsy.

In 2025, she paid $535 monthly for a mid-level silver exchange plan. This year, her premium quote has risen to $823 per month.

Despite the jump in premiums, her actual healthcare expenses remain modest. Her epilepsy medication costs approximately $175 every three months without insurance, and annual doctor visits total roughly $250. After earning about $55,000 last year, she determined that covering routine care out of pocket would cost significantly less than nearly $10,000 annually in premiums.

This situation is not an argument for reinstating enhanced subsidies. Instead, it underscores the insurance market’s dysfunction.

Insurance should protect against catastrophic health events—not pre-pay for predictable, routine medical expenses.

Obamacare effectively eliminated most low-cost, catastrophic-style policies by mandating that all plans cover ten essential health benefits, requiring insurers to accept applicants regardless of health status or history, and banning age-based pricing. These rules have made comprehensive coverage mandatory but prohibitively expensive.

Since 2014—the year Obamacare’s regulations took effect—exchange premiums have more than doubled for many Americans. For younger and healthier individuals, comprehensive coverage often fails to provide financial sense.

According to the Peterson-KFF Health System Tracker, the bottom 50% of Americans by total health spending in 2022 averaged just $374 that year. In 2021, Americans aged 19 to 34 spent an average of about $629 out of pocket.

Spending hundreds each month on premiums for events that rarely occur is financially irrational.

A more sensible solution would be lower-cost catastrophic coverage—policies designed to protect against major medical emergencies while allowing routine care to be paid out of pocket.

On February 9, the Centers for Medicare and Medicaid Services proposed a rule that would expand eligibility for catastrophic plans and allow insurers to offer multi-year versions. Public comments on this proposal are due by March 11, potentially giving consumers alternatives to today’s expensive exchange plans.

Pairing catastrophic coverage with a health savings account could be even more effective. Individuals can contribute up to $4,400 tax-free this year for routine expenses.

For someone with modest annual medical costs, such a combination offers financial protection at a fraction of comprehensive plan costs.

Extending enhanced subsidies would have been costly. The Congressional Budget Office estimated that renewing them through 2035 could cost approximately $350 billion.

This sum represents an enormous expenditure to offset premiums inflated by regulatory changes.

Additionally, the subsidies expanded eligibility beyond Obamacare’s original scope. They enabled some higher-income individuals to retire early or reduce work hours while taxpayers covered most of their insurance costs.

While this might seem rational in response to incentives, it raises questions about whether taxpayer dollars are best used to support early retirement or fewer work hours.

The real issue revealed by expiring subsidies is not that Americans need more federal assistance. Instead, Obamacare has made affordable, limited-benefit coverage largely unavailable—and then relied on subsidies to conceal the problem.

As Americans confront the true cost of their coverage, policymakers should address the situation without reinstating expensive subsidies. Expanding access to lower-cost catastrophic options could provide a sustainable path to affordability and save taxpayers billions.

Sally C. Pipes is President, CEO, and Thomas W. Smith Fellow in Healthcare Policy at the Pacific Research Institute. Her latest book is The World’s Medicine Chest: How America Achieved Pharmaceutical Supremacy—and How to Keep It. Follow her on X @sallypipes.