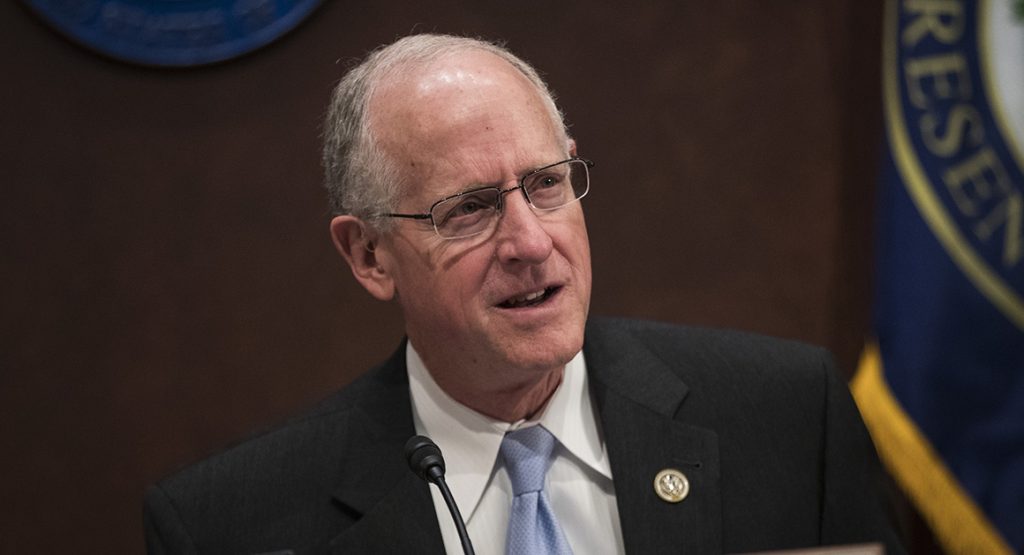

Former Texas Rep Mike Conaway Warns Against Union Pacific-Norfolk Southern Merger

WASHINGTON, DC - MAY 23: Rep. Mike Conaway (R-TX), now leading the House Intelligence investigation after Devin Nunes was forced to recuse himself, arrives for a hearing featuring former Director of the U.S. Central Intelligence Agency (CIA) John Brennan at the House Permanent Select Committee on Intelligence on Capitol Hill, May 23, 2017 in Washington, DC. Brennan is discussing the extent of Russia's meddling in the 2016 U.S. presidential election and possible ties to the campaign of President Donald Trump. (Photo by Drew Angerer/Getty Images)

By Fmr. Rep. Mike Conaway | Wednesday, 03 December 2025

As the former Chairman of the House Agriculture Committee, I stand against any proposed merger between Union Pacific and Norfolk Southern. Such a move would create a coast-to-coast monopoly in the freight rail industry — undermining competition, potentially raising prices for consumers, and putting American farmers at an undeniable disadvantage.

While proponents often tout benefits like “efficiency” and “cost savings,” this specific deal paints a different picture. It’s clear from farm groups’ concerns that it would reduce service reliability and increase shipping costs during critical times when margins are already thin. That’s not the solution agricultural producers need, especially in states heavily reliant on these vital markets.

Take my home state of Texas as just one example: with over 230,000 farms depending daily on rail transport to move their corn, cotton, and wheat to market, and receive essential supplies like fertilizer. These farmers are counting on fair competition to keep costs down. When they say this merger would harm reliability, I take it seriously.

The freight rail sector is already dominated by a handful of Class I carriers. More consolidation will only make existing problems worse — service disruptions, delays, rate hikes that ripple through every part of the supply chain for goods moving across America.

Even other major players in the industry are sounding alarm bells about this proposed combination. BNSF has presented data showing how this merger would harm competition and potentially increase shipping costs further — directly threatening shippers who already face difficult circumstances without enough rail options available to them. When direct competitors acknowledge that consolidation goes too far, we should listen.

Consolidation isn’t the answer for improved efficiency in transportation.

Existing intermodal service agreements between major carriers show how collaboration and route coordination can improve freight movement without eliminating competition entirely. Cooperation strengthens our system; concentration weakens it further.

At a time when national focus rightly centers on strengthening domestic manufacturing and food security, another rail mega-merger seems misplaced. Transportation costs already account for nearly four percent of the cost of food we eat — any rise would directly impact consumer budgets across America.

This administration has responsibilities to uphold antitrust standards that protect competition within our economy.

The Surface Transportation Board must apply common sense in evaluating this proposed merger, ensuring it enhances not erodes market competition. Regulators should prioritize protecting shippers’ interests over corporate profits when making these important determinations for the future of American freight transportation.

America’s food supply chain depends on open markets and fair prices — let’s ensure our transportation system reflects that principle rather than enabling dominance by a few major carriers at the expense of all others involved.